On 20th Oct, 2018, the Inland Revenue (State Administration of Taxation) announced a drafted Interim Regulation regarding the additional deduction of Individual income tax.

There are 6 items considered to be deductable from individual income which is mainly suggested as salary.

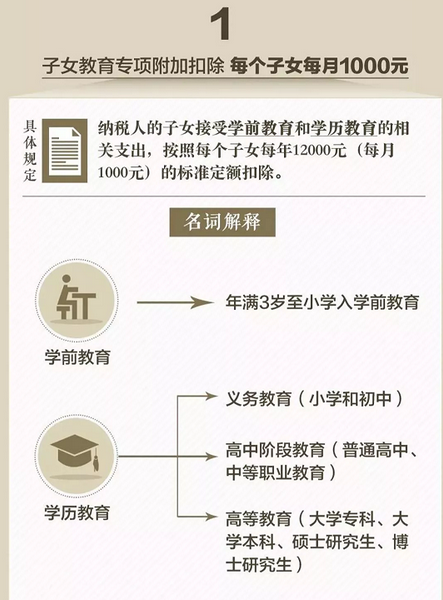

一、Children’s education fees: CNY1,000 per month for each child. (Up to 2 children since the second child policy is just opened)

1. From 3 year old to PHD graduated

2. 50%-50% between parents, or 100% from one parent.

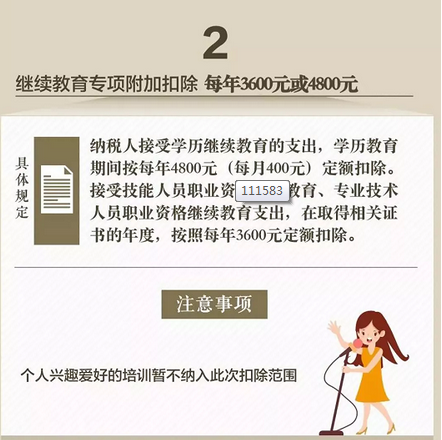

二、Continuing education fee: CNY4,800 per year for curricula education and CNY3,600 for professional education.

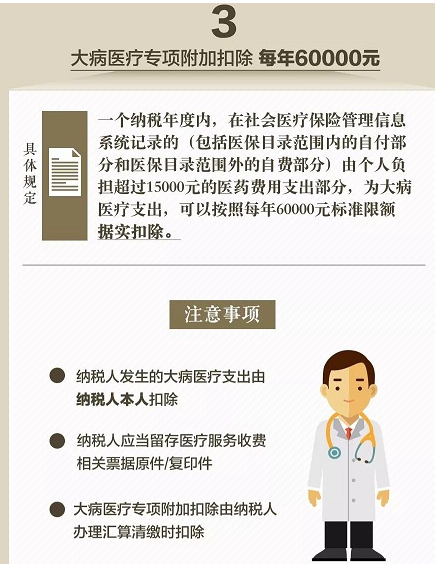

三、Serious illness: Up to CNY60,000 per year if the personal burden medicine expense is exceed CNY15,000 in a financial year.

1. The medicine expense is attached to taxpayer himself only

2. The deduction reply on the original medicine receipts or hard copies

3. The medicine expense is claimed during the annual self-assessments

四、Mortgage interest: CNY1,000 per month for the first property of the taxpayer or his/her spouse

1. Husband or wife applies the deduction

2. Only the first buy

3. Only one property of the first buy

五、Rental deduction: CNY800 – 1,200 per month

1. Taxpayer or his/her spouse has no property in the city they are working. And they rent a property

2. Main cities up to CNY1,200 per month.;Cities over 1M population up to CNY1,000 per month; Other cities yup to CNY800 per month.

3. Husband or wife applies the deduction if they work at same city; Husband and wife apply for each portion if they work in different cities.

4. Mortgage interest deduction and rental deduction can only apply for one

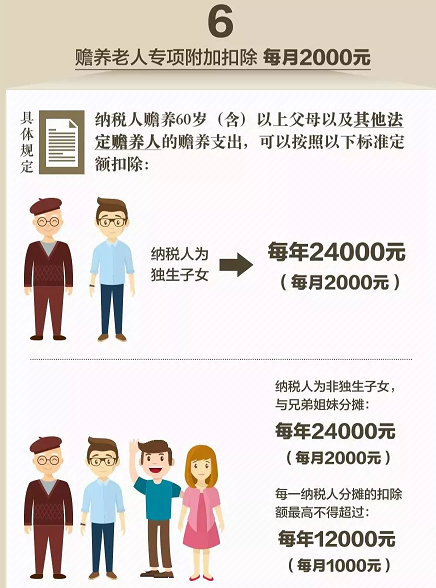

六、Maintenance obligations of the old: CNY2,000 per month if parents or other old are over 60 year old.

1. CNY2,000 per month if the taxpayer is only child

2. CNY1,000 per month if the taxpayer has sibling

3. Only claim for once even the old are 2 or even more

To compliant with the new regulation, the taxpayer must file accurate information and data on self-assessment system. This kind system will be no doubt active online soon. From that moment, a professional accountant will be needed for every taxpayer. We are here to help.

Call us at 010-58644470,email to Info@accountingbeijing.com. or leave message on the front page of our website. You will find answer there.

Source:http://yjzj.chinatax.gov.cn/hudong/noticedetail.do?noticeid=1701566